Introduction

In today’s interconnected world, many people are looking for more flexible banking options that allow them to manage their finances seamlessly across borders. One popular option is opening a relay bank account. But for Pakistani citizens, the question remains: can Pakistanis open a relay bank account? In this article, we will explore the details of relay bank accounts, the process for Pakistanis, and important factors to consider when making this decision.

What is a Relay Bank Account?

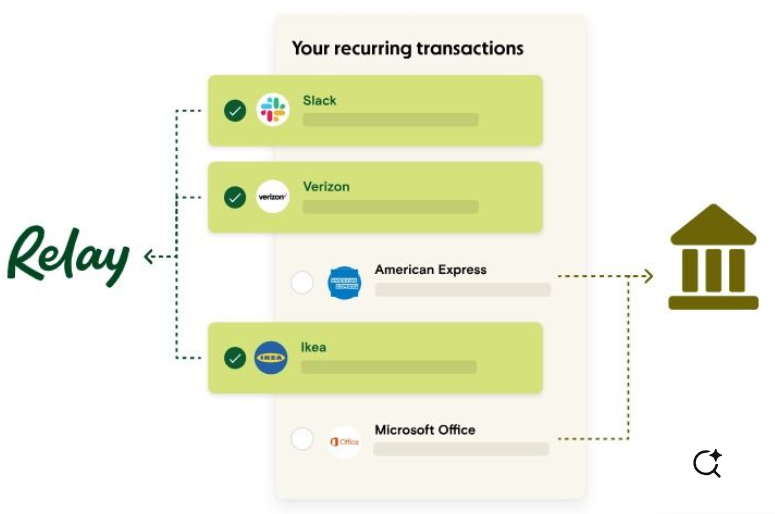

Before delving into whether Pakistanis can open a relay bank account, it’s important to understand what a relay bank account is. Essentially, a relay bank account is a type of digital or virtual bank account that allows users to store and manage funds in multiple currencies, often with fewer geographical restrictions than traditional banking systems. These accounts are designed to offer fast, secure, and borderless financial services.

Relay bank accounts are often used for international transactions, remittances, and online purchases. They are especially beneficial for those who live in countries where traditional banking is either inaccessible or limited. The main appeal of relay bank accounts is the flexibility they provide in managing funds across different countries without the need for a physical bank branch.

Can Pakistanis Open a Relay Bank Account?

Now that we understand what a relay bank account is, the next logical question is: can Pakistanis open a relay bank account? The short answer is yes, but with certain conditions.

Although Pakistanis do not have direct access to all relay banking services due to regulatory restrictions, there are several international financial institutions and digital platforms that offer relay banking services to Pakistani citizens. However, this process may vary depending on the specific provider and their policies.

Factors to Consider When Opening a Relay Bank Account in Pakistan

When thinking about opening a relay bank account as a Pakistani citizen, there are several factors you should consider:

1. Eligibility Criteria

Not all relay bank accounts are open to Pakistani residents. Most platforms that offer relay bank accounts have specific eligibility criteria, which include factors like age, nationality, and residency status. Pakistani citizens who meet these criteria can open a relay bank account, while others may face restrictions.

2. Verification Process

To open a relay bank account, Pakistanis typically need to undergo a verification process. This may include submitting identification documents, proof of address, and other personal information to ensure the security and legitimacy of the account holder. Depending on the platform, this process can take anywhere from a few hours to several days.

3. Account Features

Different relay bank accounts offer various features, such as multi-currency support, international remittance services, and online payment solutions. As a Pakistani, it’s important to choose a relay bank account that offers the services you need. Be sure to compare the features of different platforms before making a decision.

4. Fees and Charges

Some relay bank accounts charge fees for certain transactions or account maintenance. Be sure to carefully read the terms and conditions of any relay bank account before you sign up. Understanding the fee structure is crucial, as hidden fees can significantly impact your finances.

5. Currency Exchange Rates

Many relay bank accounts offer currency exchange services for international transactions. However, exchange rates can fluctuate, and sometimes the rates offered by relay accounts are not as competitive as those provided by traditional banks. Keep this in mind when using a relay account for cross-border transactions.

6. Security and Compliance

Security is always a priority when handling financial transactions. When choosing a relay bank account provider, ensure that they are compliant with international financial regulations and have robust security measures in place, such as encryption and fraud protection.

7. Accessibility and User Experience

The ease of use and accessibility of the relay bank account are important factors to consider. Make sure the platform is user-friendly, offers customer support in case of issues, and allows easy access to your funds when needed.

Top Relay Bank Account Providers for Pakistanis

While Pakistanis may face some challenges when opening a relay bank account, several international providers cater to Pakistani citizens. Here are a few options to consider:

1. Wise (formerly TransferWise)

Wise is one of the most popular options for opening a relay bank account, especially for cross-border transactions. Pakistanis can use Wise to store and transfer funds in multiple currencies. The platform also offers competitive exchange rates and low transaction fees.

2. Revolut

Revolut is another digital banking platform that provides relay banking services. Pakistanis can open an account with Revolut to manage multiple currencies, make international payments, and even trade in cryptocurrencies. However, users should be aware that Revolut may have limitations on Pakistani residents based on regulatory conditions.

3. Payoneer

Payoneer is widely used for international business transactions and is accessible to Pakistani citizens. With Payoneer, you can open a relay bank account and receive payments in multiple currencies. It’s ideal for freelancers and businesses looking to receive global payments.

4. N26

Although N26 is primarily based in Europe, it offers relay banking services to international users, including Pakistanis. N26 provides features like multi-currency accounts, international transfers, and mobile banking services.

Pros and Cons of Relay Bank Accounts for Pakistanis

Just like any banking solution, relay bank accounts have their advantages and disadvantages. Let’s explore some of the pros and cons specifically for Pakistani users.

Pros:

- Global Accessibility: Relay bank accounts offer access to global financial services, which is useful for Pakistanis who need to send or receive international payments.

- Low Fees: Compared to traditional banking methods, relay bank accounts often have lower transaction fees, especially for international transfers.

- Multi-Currency Support: Relay bank accounts allow users to store and manage multiple currencies in a single account, which is convenient for those who deal with foreign currencies.

- Faster Transactions: Relay accounts enable faster international transactions, allowing Pakistanis to send or receive money in a matter of minutes.

Cons:

- Limited Availability: Not all relay bank account providers accept Pakistani users due to regulatory restrictions.

- Currency Conversion Fees: Although exchange rates may be favorable, some platforms charge currency conversion fees that can add up.

- Regulatory Issues: The regulatory environment in Pakistan may change, affecting the accessibility of relay bank accounts in the future.

- Account Maintenance Fees: Some providers charge maintenance fees for using relay accounts, which may not be ideal for people with low transaction volumes.

Conclusion

In conclusion, Pakistanis can open a relay bank account through several international providers, but they must carefully consider the eligibility requirements, fees, and available features. Relay bank accounts provide a convenient way for Pakistanis to manage their finances across borders, especially for international transactions, business payments, and remittances. However, it’s important to choose the right provider, ensure that the platform is secure, and be aware of any additional charges that may apply.

Ultimately, a relay bank account can offer Pakistanis an easy way to manage their money globally, but it’s essential to understand the various factors involved before making a decision. With the right research and careful planning, opening a relay bank account can be a beneficial financial move for Pakistani citizens seeking to navigate the global economy.