Introduction

The Inverse Head and Shoulders pattern is one of the most reliable and powerful chart patterns used in technical analysis. This pattern is popular among traders and investors because it signals a potential bullish reversal, indicating that the market might shift from a downtrend to an uptrend. In this article, we will explore everything you need to know about the Inverse Head and Shoulders pattern, including how to identify it, how it works, and how to trade it effectively.

What is the Inverse Head and Shoulders Pattern?

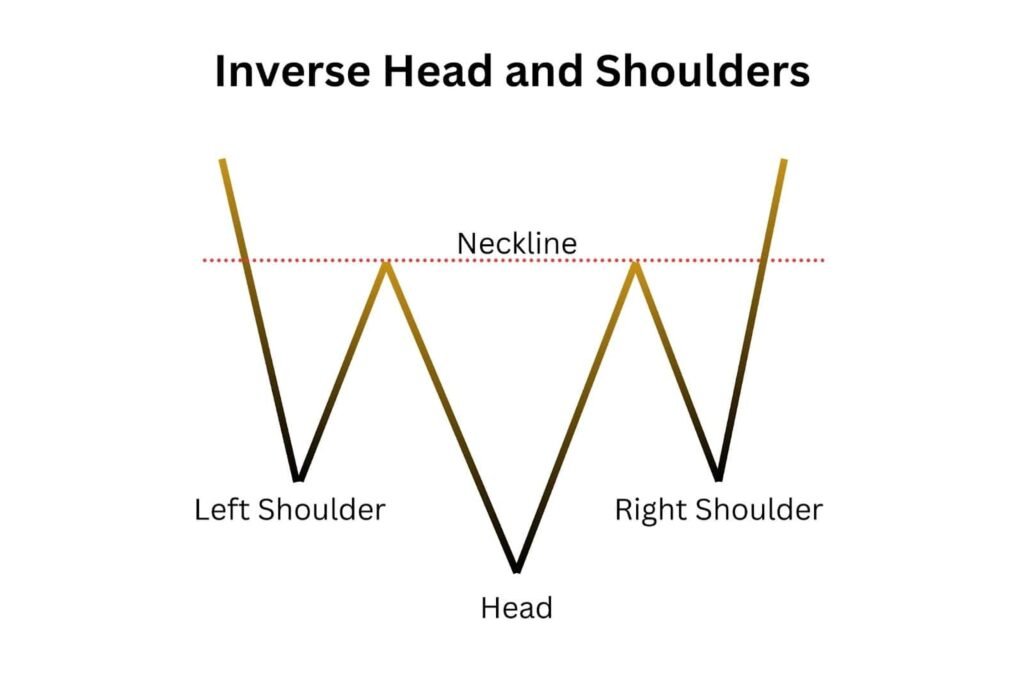

This pattern is a bullish reversal pattern that appears after a downtrend. It consists of three parts:

- Left Shoulder: A price decline followed by a small rally.

- Head: A lower low than the left shoulder, followed by another rally.

- Right Shoulder: A higher low than the head, indicating buying interest.

These three parts form a shape similar to an upside-down head with shoulders, hence the name Inverse Head and Shoulders. The pattern is confirmed when the price breaks above the “neckline,” which is a resistance line drawn across the highs of the left shoulder and the right shoulder.

How to Identify the Inverse Head and Shoulders Pattern

To accurately identify the pattern, look for the following features:

- Downtrend Preceding the Pattern: This pattern typically forms at the end of a downtrend.

- Left Shoulder: A decline in price followed by a temporary rally.

- Head: A deeper decline than the left shoulder, followed by another rally.

- Right Shoulder: A decline that is shallower than the head, signaling that sellers are losing strength.

- Neckline: A resistance line connecting the highs of the left and right shoulders.

- Breakout: The pattern is confirmed when the price breaks above the neckline with strong trading volume.

By correctly identifying these elements, traders can recognize the pattern and anticipate a potential trend reversal.

Why is the Inverse Head and Shoulders Pattern Important?

This pattern is highly regarded by traders because it signals a potential reversal from a downtrend to an uptrend. This allows traders to enter buy positions at the right time, maximizing their profit potential.

This pattern is important for the following reasons:

- It indicates a shift in market sentiment from bearish to bullish.

- It provides a clear entry point when the neckline is broken.

- It helps traders set profit targets by measuring the distance from the head to the neckline.

By understanding the importance of the pattern, traders can make more informed trading decisions.

How to Trade the Inverse Head and Shoulders Pattern

It comprises of three key steps:

1. Identify the Pattern

First, identify the pattern with its left shoulder, head, right shoulder, and neckline. Ensure the pattern forms after a downtrend.

2. Wait for Breakout Confirmation

The pattern is confirmed when the price breaks above the neckline with strong volume. This breakout indicates that buyers are in control.

3. Enter the Trade

Enter a buy position after the breakout. To minimize risk, place a stop-loss order below the right shoulder.

4. Set Profit Target

To set a profit target, measure the distance between the head and the neckline. Add this distance to the breakout point to determine the price target.

By following these steps, traders can effectively trade the pattern and maximize their profit potential.

Common Mistakes to Avoid

While this pattern is a reliable trading tool, traders often make mistakes that can lead to losses. Here are some common mistakes to avoid:

- Entering Too Early: Wait for a confirmed breakout above the neckline before entering a trade.

- Ignoring Volume: A breakout with low volume is less reliable. Ensure strong volume confirms the breakout.

- Improper Stop-Loss Placement: Place the stop-loss below the right shoulder to manage risk effectively.

By avoiding these mistakes, traders can increase their chances of success when trading the Inverse Head and Shoulders pattern.

Example of this Pattern

Let’s look at an example to understand how the Inverse Head and Shoulders pattern works in real trading.

Imagine a stock is in a downtrend and forms the following pattern:

- Left Shoulder: The price drops to $50, then rallies to $60.

- Head: The price drops further to $45 and then rallies back to $60.

- Right Shoulder: The price declines to $52, forming a higher low than the head.

The neckline is drawn at $60. When the stock breaks above $60 with high trading volume, the Inverse Head and Shoulders pattern is confirmed. Traders can enter a buy position at $60 and set a stop-loss below the right shoulder at $52.

By following this strategy, traders can profit from the bullish reversal signaled by the Inverse Head and Shoulders pattern.

FAQs

Q1: Is the Inverse Head and Shoulders pattern reliable?

Yes, the Inverse Head and Shoulders pattern is considered one of the most reliable bullish reversal patterns. However, confirmation with volume is essential to avoid false breakouts.

Q2: Can this pattern be used in all markets?

Yes, the Inverse Head and Shoulders pattern can be used in various financial markets, including stocks, forex, and cryptocurrencies.

Q3: What is the best time frame for this pattern?

This pattern works well on daily and weekly charts, but it can also be applied to shorter time frames for day trading.

Q4: How do I confirm the breakout?

Confirmation occurs when the price breaks above the neckline with strong trading volume. This indicates buying pressure and a potential trend reversal.

Q5: Can the pattern fail?

Yes, like all technical patterns, the Inverse Head and Shoulders pattern is not 100% accurate. False breakouts can occur, so risk management is essential.

Q6: What is the difference between Head and Shoulders and Inverse Head and Shoulders?

The Head and Shoulders pattern is a bearish reversal pattern, while the Inverse Head and Shoulders is a bullish reversal pattern.

Q7: How do I set a stop-loss?

Place the stop-loss below the right shoulder to minimize risk and protect against unexpected price movements.

Conclusion

The Inverse Head and Shoulders pattern is a powerful tool for traders looking to identify bullish reversals. By understanding how to identify and trade this pattern, traders can make more informed decisions and increase their profit potential. However, it is essential to wait for breakout confirmation with strong volume to avoid false signals.

This pattern is widely used in technical analysis and is known for its reliability and effectiveness. By practicing patience and avoiding common mistakes, traders can maximize their gains using this pattern.

Explore more at futurefinancevision.com